INFORMATION

Latest Activities

| 20.1.2026 | Opinion [LINK] Contribution published in Nikkei's "Shiken Takken" opinion column. |

| 14.5.2025 | Opinion [LINK] Submitted our comments to Tokyo Stock Exchange, Inc. |

| 28.4.2025 | Campaign [English] [日本語] Revealed our campaign website for HS Holdings (8699) |

View all activities

| 19.12.2024 | Opinion [English] [日本語] Submitted our comments to the Planning and Markets Bureau, Corporate Disclosure Division, FSA |

| 2.12.2024 | Campaign [English] [日本語] Updated on our campaign website for Wakamoto (4512) |

| 16.10.2024 | Campaign [English] [日本語] Archived our campaign website for YSK (2812) |

| 29.7.2024 | Opinion [LINK] Submitted our comments to the Sustainability Standards Board of Japan |

| 8.7.2024 | Insight [LINK] Issued "Japan Shareholder Proposals Report 2024" |

| 19.3.2024 | Campaign [English] [日本語] Revealed our Second campaign website for Wakamoto (4512) |

| 24.11.2023 | Miscellaneous [LINK] Attended and contributed to the panel discussion at the "Equity Managers Roundtable: the State of the Market and How to Position a Portfolio in the Current Environment", an event organised by the Investment Management Club at the London Business School |

| 8.11.2023 | Miscellaneous [LINK] Contributed to the paper "Institutional Investors, Securities Lending, and Short-Selling Constraints" by Taisiya Sikorskaya, PhD Candidate at London Business School |

| 1.8.2023 | Opinion [English] [日本語] Submitted our comments to the Fair Acquisition Study Group, METI |

| 7.7.2023 | Insight [LINK] Issued "Japan Shareholder Proposals Report 2023" |

| 23.3.2023 | Disclosure [LINK] Revealed the Shareholder Activism Outsourcing Service |

| 10.3.2023 | Opinion [LINK] Submitted our comments to the Fair Acquisition Study Group, METI |

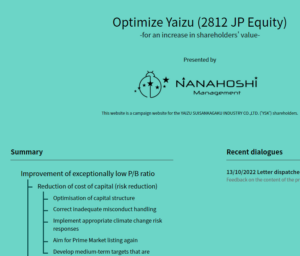

| 23.12.2022 | Campaign [English] [日本語] Revealed our first campaign website for YSK (2812) |

| 13.12.2022 | Disclosure Revealed this website |

EDGE

NEWS & MEDIA

| 22.1.2026 [日本語][English] ブルームバーグ・ニュース「英アクティビストが創業家の株安放置に圧力、パソナGとツツミに書簡」 |

| 23.12.2025 [日本語][English] 日本経済新聞朝刊19面「「アクティビスト地獄」の予兆 ファンドも難局に」 |

| 25.11.2025 [日本語のみ] 野村総合研究所「Independent Managers Club 第四活動報告書(6頁、19頁、22頁及び23頁)」 |

| 31.10.2025 [日本語のみ] 大和総研コンサルティングレポート「2025年6月株主総会シーズンの総括と示唆(14頁図表13)」 |

| 9.10.2025 [日本語のみ] 日経ビジネス「現預金抱え込みで割安な企業、最下位はパソナ アクティビストの標的に」 |

View all

| 11.7.2025 [日本語][English] 日経ヴェリタス「2025株主総会の乱 アクティビスト社長が中計練り直し」 |

| 26.6.2025 [日本語][English] 日本経済新聞朝刊20面「資本騒乱 総会リセット 当事者に聞く(中)ガラパゴス市場、変える」 |

| 16.6.2025 [日本語][English] 日本経済新聞朝刊1面「資本騒乱 総会リセット(1)安くなった株主提案」 |

| 13.6.2025 [日本語のみ] マネックス証券-アクティビストタイムズ「2025年、株主総会シーズン本格化でESG提案出揃う」 |

| 2.6.2025 [日本語のみ] ZAITEN 2025年7月号「製薬業界〝火花散る〟波乱の総会展望(35頁)」 |

| 29.5.2025 [日本語のみ] 大和総研コンサルティングレポート「2025年6月株主総会に向けた論点整理(8頁図表6及び9頁図表7)」 |

| 18.4.2025 [日本語のみ] 菊地正俊『外国人投資家の思考法と儲け方』86-87頁(日本実業出版社) |

| 9.1.2025 [日本語][English] ダイヤモンドオンライン「株主必見!企業は賃貸等不動産を例外なく売却すべき?著名投資家・井村俊哉氏とアクティビスト・松橋理氏がガバナンス改革を激論【対談後編】」 |

| 29.12.2024 [日本語][English] ダイヤモンドオンライン「大株主が「経営陣との交渉過程」を赤裸々公開!著名投資家・井村俊哉氏とアクティビスト・松橋理氏が交渉術を激論【対談前編】」 |

| 26.12.2024 [日本語のみ] ZAITEN 2025年2月号「「わかもと製薬」〝モノ言う株主〟との第2ラウンド(37頁)」 |

| 7.11.2024 [日本語][English] White & Case "Japan 2024 Proxy Season" |

| 16.8.2024 [日本語][English] M&A Research Report Online「近時のアクティビスト活動と2024年6月株主総会概観」 |

| 6.8.2024 [日本語][English] 東京新聞TOKYO Web「知ってる?動物が持つ『5つの自由』 パリ五輪に見る『アニマルウェルフェア』の世界基準、なぜ日本は後ろ向き」 |

| 2.7.2024 [日本語][English] 日本経済新聞電子版「動物福祉の株主提案、賛成5.3%で否決」 |

| 27.6.2024 [日本語][English] 読売新聞大阪本社版夕刊4面「動物福祉 株主提案」 |

| 26.6.2024 [日本語][English] ダイヤモンドオンライン「「実験動物の購入頭数を開示せよ!」わかもと製薬に異例の株主提案をしたアクティビストを直撃」 |

| 24.6.2024 [日本語][English] 週刊ダイヤモンド2024年6月29日号「【特集2】激変!株主総会2024(70頁)」 |

| 24.6.2024 [日本語][English] 週刊東洋経済2024年6月29日号「中小型&地方も油断禁物 物言う株主が狙う企業・「物言う株主」に狙われる企業ランキング(54頁図表及び58頁)」 |

| 17.6.2024 [日本語][English] 日本経済新聞朝刊15面「「動物福祉」求める株主 日本でも総会議案 わかもと製薬が試金石」 |

| 16.6.2024 [日本語のみ] 菊地正俊『アクティビストの正体―対話と変革を促す投資家の戦略』155-156頁(中央経済社) |

| 1.6.2024 [日本語のみ] 医薬経済2024年6月1日号(1709号)12-13頁「わかもと製薬に株主提案 新興アクティビストに直撃」 |

| 25.5.2024 [日本語のみ] 資料版/商事法務 482号(2024.05)117-121頁「ESG株主に聞く<第6回>ナナホシマネジメント」 |

| 24.5.2024 [日本語][English] 日本経済新聞朝刊3面「MBO、昨年度に過去最高1.4兆円 大正製薬やベネッセなど18社 企業に規律、新陳代謝促す」 |

| 13.5.2024 [日本語のみ] 半澤智『PBR革命 ESGも情報開示も価値に変える新しい経営の指標』201-202頁(日経BP) |

| 22.4.2024 [日本語][English] 日本経済新聞朝刊17面「一目均衡 「政策保有先分」もあなたの責任、気候変動影響の開示」 |

| 15.4.2024 [日本語のみ] 鈴木紀子=宮地真紀子=宮原真紀『アクティビスト対応の実務』91頁(中央経済社) |

| 8.4.2024 [日本語][English] M&A Research Report Online「アクティビスト最新動向、TOB価格や統合比率への介入増加」 |

| 19.3.2024 [日本語][English] Business Wire "Nanahoshi Management Ltd.: Strengthen Wakamoto Activist Campaign (TOKYO:4512) Is Released" |

| 7.2.2024 [日本語][English] 日本経済新聞朝刊地域経済(静岡)「いなば食品系が焼津水化買収へ 県内資本主導で再建」 |

| 22.1.2024 [日本語][English] M&A Research Report Online「2024年のM&A市場を展望する(3) 外国人投資家関与のアクティビスト活動が活発化へ」 |

| 22.12.2023 [日本語のみ] 菊地正俊『低PBR株の逆襲』239-241頁(日本実業出版社) |

| 6.12.2023 [日本語][English] White & Case "Japan 2023 Proxy Season" |

| 26.11.2023 [日本語][English] 日本経済新聞朝刊3面「MBO最高の1兆円超 23年、大正製薬やベネッセ相次ぎ 東証・物言う株主 圧力」 |

| 20.11.2023 [日本語][English] M&A Research Report Online「2023年下期のアクティビスト活動概観~資本市場からの要請に対する対応は途上段階」 |

| 6.11.2023 [日本語][English] 週刊東洋経済2023年11月11日号「あなたの会社も狙われる アクティビスト全解明(51頁図表並びに55頁及び58頁)」 |

| 17.10.2023 [日本語][English] 東洋経済オンライン「村上系ファンドの餌食に、静岡・老舗企業の盲点 拙速なTOBに対してアクティビストが揺さぶり(2頁目)」 |

| 6.10.2023 [日本語][English] 日本経済新聞朝刊23面「TOB、14年ぶり多さ 1~9月49件 企業、価値向上を意識」 |

| 15.9.2023 [日本語のみ] 大和総研コンサルティングレポート「2023年6月株主総会シーズンの総括と示唆(10頁図表12及び11頁図表13)」 |

| 8.9.2023 [日本語][English] M&A Research Report Online「Webインタビュー【第162回】イギリスを拠点に、アクティビスト活動を展開」 |

| 8.9.2023 [日本語][English] 日経ESG 2023年10月号「ニデックが低PBR企業に同意なき買収 東証のPBR要請がM&Aを後押し(13頁)」 |

| 27.7.2023 [日本語][English] M&A Research Report Online「注目の2023年6月定時株主総会でのアクティビスト活動の総括(3頁目)」 |

| 15.7.2023 [日本語のみ] 旬刊商事法務2332号58頁「スクランブル 6月総会株主提案事例の概観とアクティビストの行動形態の変容」 |

| 8.7.2023 [日本語][English] 日経ヴェリタス第800号1面「地方にキラリお宝株」及び3面「物言う株主の圧力が地方にも」 |

| 7.7.2023 [日本語][Engligh] Business Wire "Nanahoshi Management issued the “Japan Shareholder Proposals Report 2023”" |

| 27.6.2023 [日本語][English] 週刊東洋経済2023年7月1日号「2023年6月総会で株主提案を受けた90社リスト②(82頁図表)」 |

| 23.6.2023 [日本語][English] 中日BiZナビ「アクティビスト提案を否決 焼津水産化学工業の株主総会」 |

| 18.5.2023 [日本語][English] 日本経済新聞朝刊16面「「PBR1倍割れ改善を」物言う株主、配当拡充などを要求」 |

| 23.3.2023 [日本語][English] Business Wire "Nanahoshi Management Unveils the Shareholder Activism Outsourcing Service" |

| 25.1.2023 [日本語] [English] GVA法人登記「導入事例(商業・会社変更登記申請オンライン支援サービス)」 |

| 22.12.2022 [日本語][English] Business Wire "Nanahoshi Management Discloses Its Campaign Website “Optimize Yaizu (2812 JP Equity)”" |

ABOUT

Nanahoshi Management Ltd.

株式会社ナナホシマネジメント

2-13-22 Higashinakano, Nakanoku, Tokyo, Japan, 164-0003

東京都中野区東中野二丁目13番22号

Founder / CEO

Satoru Matsuhashi, CFA, CESGA

代表取締役 松橋 理

He has 16 years of experience in equity investment as a fund manager and research analyst. He recently worked as a shareholder activism professional in Japan.

He earned Masters in Finance at London Business School, holds Investment Management Diploma (ESG) from CFA UK, and received Sustainability and Climate Risk Certificate (SCR) from GARP.